The Independent Report provides an independent, non-partisan, non-ideological analysis of economic news. The Independent Report's mission is to inform its readers about the unsustainable nature of our economic system and the various stresses encumbering it: high debt levels (government, business, household); debt growth exceeding economic growth; low productivity growth; huge and persistent trade deficits; plus concurrent stock, bond and housing bubbles.

Wednesday, August 11, 2010

State Budget Crises May Be Catastrophic

The Great Recession and its aftermath have created a bitter reality in state capitals across the nation. States are facing the third straight year of crippling budget deficits, resulting in widespread layoffs, and lost services for millions of taxpayers.

In June, the states collectively shed 20,000 jobs. While some may argue that this simply cut fat and shed dead weight, it deeply impacted 20,000 American families. And yet there are far more pink slips still to be handed out.

The recession has caused the steepest decline in state tax receipts on record.

State revenues have taken a beating as property values dropped, unemployment soared, and cash-strapped shoppers spend less.

More people are collecting unemployment insurance, while fewer are paying into the system. The need for welfare services is increasing and one-in-eight Americans are now using food stamps.

State governments have reacted strongly by slashing spending. For the first time in four decades of collecting data, the National Governors Association (NGA) reports that total state spending has dropped for two years in a row. That has reduced the nation's GDP even as private sector demand is shrinking.

A total of 48 states faced budget shortfalls totaling $200 billion — or 30% of state budgets — for fiscal year 2010, the largest gaps on record.

As a result, states cumulatively initiated $200 million in budget cuts. That will only result in even more job losses, less services, a lower GDP, and more pain. And since K-12 education accounts for nearly a third of all spending from state general funds, there will indeed be a lot of pain.

It's estimated that states will have to deal with total budget shortfalls of some $260 billion for 2011 and 2012.

What's worrisome is that these budget gaps could go on for many years, perhaps as long as a decade by some estimates.

Despite closing more than $300 billion in cumulative budget gaps since fiscal 2008, states are facing a projected $125 billion gap for the coming years, according to the National Conference of State Legislatures (NCSL).

Some 48 states are already contending with painful cuts to their 2010 fiscal budgets, and yet at least 46 states still face shortfalls for the upcoming 2011 fiscal year, which in most states began July 1.

As it stands, 11 states are projecting budget deficits greater than 10% of general-fund spending into 2013. There is widespread fear that many cities and municipalities across the nation may go bankrupt. Municipal bonds could be the next debt crisis.

Aside from K-12 costs, Medicaid, prisons, colleges and universities, plus interest on bonds and other debts, must all be maintained.

Medicaid is anticipated to grow by an estimated 5.4% on average next year. Meanwhile, funding isn't anticipated to grow much at all.

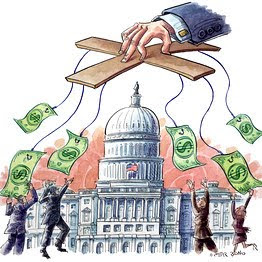

All of this bad news continues to roll in as federal stimulus funds are waning. The states need more emergency aid, but Washington is broke and awash in red ink. Most Republicans are loathe to provide more aid since it will only add to the nation's ballooning debt.

Desperately in need of revenues, many states are enacting or contemplating tax hikes, which will only make a bad economic environment even worse by reducing the amount of money consumers have to spend.

States like California, New York and Illinois are the poster children for this epic budget crisis.

California is facing a whopping $19 billion shortfall, equaling 22 percent of its $85 billion general fund. That kind of math adds up to big trouble.

New York is grappling with a $9.2 billion gap. And Illinois is saddled with a $12 billion deficit, equal to nearly half the state's budget.

Additionally, massive shortfalls in state public pension plans loom as well, the victim of falling stock and real estate prices. As of 2008, just four states had fully funded pension programs. As a result, there are massive problems on the horizon.

The Pew Center on the States, a nonpartisan research group, estimates that states are at least $1 trillion short of what it will take to keep their retirement promises to public workers. However, that estimate was based on fiscal 2008 data; we are now in fiscal 2011 and the situation has only gotten worse.

Two Chicago-area professors recently calculated the pension shortfall at a whopping $3 trillion.

A report just out from the Center on Policy Analysis concurs. It indicates that state and local pension funds are drastically underfunded to the tune of $3 trillion. That's simply stunning, and it's a horrible omen of what's to come.

The Illinois pension system, for instance, is at least 50 percent underfunded. Some analysts warn that it could push the state into insolvency if the economy doesn't pick up. The problem, according to Fitch Ratings, is that Illinois cannot grow its way out of the problem.

Illinois reports that it has $62.4 billion in unfunded pension liabilities, although many experts place that liability tens of billions of dollars higher.

Governor Pat Quinn proposes borrowing $3.5 billion to cover a year’s worth of pension payments, which would cost about $1 billion in interest. Illinois' poor credit rating means it now pays millions of dollars more to insure its debt than any other state in the nation. Last year, the comptroller’s office paid $55.3 million just in interest on two short-term borrowings to pay the state’s bills.

Both California and New York have economies larger than Greece's. And California's deficit is also larger. While the Greek deficit totaled $22.5 billion last year, the government made huge cuts that reduced it to just over $12 billion in the first half of this year. That means that Greece's current deficit is more than 50 percent lower than California's current shortfall.

California's pension problems are simply breath-taking, with an estimated $500 billion in unfunded pension obligations. That's a figure that could cripple the state for many years to come. Unless the state defaults, those are legal obligations that California must somehow pay. No one knows how that will happen.

In fact, under the law, all state and local pensions are non-negotiable. They are mandatory and will be funded at the expense of higher taxes or reduced services, such as healthcare, roads, or police and fire departments. By law, pension funding in some states will consume 25-30%, or more, of tax revenues.

Pension obligations may be the proverbial hump that breaks the camel's back. State's face huge battles with public employee unions, and some may attempt to follow the lead of Indiana, which decertified its public employee unions.

How all of this plays out in courts across the nation will be both fascinating and impacting. Some very ugly fights will ensue. But for the states, those fights are worth engaging. There is no other choice; they can't get money from nothing.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment